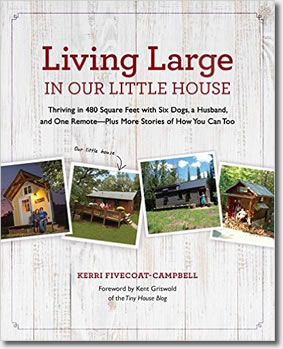

The Pain of Debt at Our Little House

One thing that has been very challenging for us since building Our Little House has been the financing.

I know, the Small House Movement converts and minimalists are probably wondering what the point was of having a small home if we still had to finance.

I’ve written before about our attitudes towards debt. We were children of the 70s and early 80s that was raised in a culture of having an attitude that debt is ok, particularly on houses and vehicles.

I even worked nearly half of my adult life in the credit industry.

Our attitudes have changed now, our whole goal is to get out of debt, but we really need to refinance Our Little House while the interest rates are low to help us achieve our goals.

When we built Our Little House, it was considered a second home and even in the pre-new-credit world, all we could secure was an ARM. This stands for Adjustable Rate Mortgage, which basically is given at a low interest rate and renewed at different intervals based on the prime rate at the moment.

The problem with these mortgages, as some of you may have read since the real estate crash, is that if the interest rates go sky high, it could price us out of our home when it comes due again. It’s also a slow way to pay off a loan.

We thought we could refinance once we moved here and this was considered our primary residence.

And then came 2008 and everything changed. Now days, a person cannot secure a good, fixed rate mortgage without excellent credit and even more importantly, I’m told, good “comps,” or comparables. These are homes comparable in size and condition that tells investors your home could sell for near this price if the loan goes bad.

Try finding a “comp” 480-square foot house with a 320-square foot office (or in-laws quarters).

Although we need less than I know some people have put into financing fancy SUVs and as a matter of fact, barely meet the minimum some companies will finance on a mortgage, we would be better off, I’ve been told by several banks and mortgage companies, if we were needing $150,000 for an average sized home.

I did, finally talk to a local mortgage company yesterday that at first, gave us the same doubtful answer. However, when he pulled some properties that might work as comps, he was surprised to have found some small homes around us that have sold within the past year.

They’re larger than ours, but ours has the added office and metal buildings, as well as a lake view going for it.

I also don’t think any of those have been featured in Mother Earth News.

Just know if you’re going for a small home, or wanting to refinance one, a mortgage might be near impossible in today’s credit climate.

And, please, send us all of your positive thoughts and good mojo this last ditch effort at refinancing for a fixed rate works out for us!

Have you tried to secure credit since the crash in 2008? If so, what was the result?

You might like daveramsey.com. He’s a financial counselor/radio host who recommends debt free living. I went through his course almost 2years ago. It changed my financial world. He recommends Churchill mortgage with a link from his site. They are a little different from other lenders doing non-FICO based scoring. Maybe they might work for you.

Best wishes and God Bless,

Tony

Thank you, Tony. If these current routes do not work, I will check into that!

Best of luck to you guys!

Thank you very much for the well wishes!

My husband and I have used: http://www.lendingtree.com/

the last couple times we refinanced. AND I’m not associated with them in anyway for the record, but when we down sized they came through for us. You get several banks that respond that you can compare rates etc… to help you reach your financial goal with your home.

Thank you, Haley. I will look at them again. I did so in the original refinancing and they sent a note back saying that no lenders would help us. Not sure if it was the size or the very remote location, but that was 8 years ago and it may have changed since.

Ooph. We have not tried to get any kind of credit since things went wonky. Surely, this will work out. We’re sending our best mojo.

Thank you, Roxanne.

I’m so sorry this is happening to you. The mortgage situation is truly insane right now; worse if you are self-employed. I recently tried to refinance and was told I no longer qualified based on my income, even though it’s for less than I qualified for two years ago (I’ve paid down the principal!) and I’ve made every payment on the current mortgage on time for two years!!! Ridiculous.

It is, Melanie. I’m sorry you’re having woes as well.

Wow, I never thought about the problem of comps with a home like yours! I hope you’re able to get the refi. Those ARMs are simply terrifying.

Yes, they are! Thanks for the good wishes!

I hope everything works out with your refinance Kerri! Sending positive thoughts your way! We moved into a new house and still haven’t sold the old one, so we’re in a double mortgage cash crunch! It really, really stinks! Maybe we can trade positive thoughts for each other!

Thanks, Kathleen. Positive thoughts coming your way, too!

Sorry to hear this! I know I will be so grateful in a year or two to have finished paying my mortgage. Debt is no fun!

Ah, to have a house paid for, what a thing to look forward to!

It’s too bad that the American Dream “has” to be 4 bedrooms and 2-1/2 bedrooms on a 1/4 acre next to a highway.

Good luck, Kerri.

Yes, it is, Mat. We’ve become such a cookie cutter society in defining our dreams, unique properties such as small homes cannot even be financed unless there’s a half dozen out there just like them that has sold within the past 12 months.

Even if all goes well it can be a pain but worth it in the long run.

Best of luck in the refi process.

Yes, it will, if it works out for us. If it doesn’t, we’re out the appraisal fee and still stuck in a bad loan.

I’m confident that positive thinking will work! 🙂