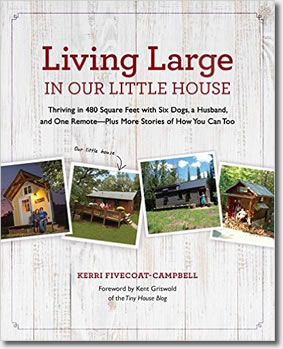

Clipping the Credit Cards

I'm cuttin' up, but I don't think credit card companies are funny

It’s a bold new credit world out there and I’m learning very quickly that I don’t like it. Last week, I cancelled our Sears store card because they had raised our interest rate to over 25 percent.

I’ve had this card for nearly 3 decades, and I have to admit, cutting it up felt a little like losing an old friend, albeit an old friend with whom I shared a dysfunctional relationship.

I’ve blogged a little bit before about our relationship with money and credit. Dale came into the marriage a believer in using cash, or if we had to use a credit card, paying it off every month.

My parents used credit very liberally. They were continually caught in the cycle of getting into debt, paying their cards off with large income tax returns, proceeds from the sale of a house, or the last time, with a small lottery hit.

As the years went on for Dale and I, and our wants became bigger, so did our debt. We never got in way over our heads, but we usually carried a balance on at least one of our cards. Since we’ve moved, I’ve tried not using them, but the recession and a few household emergencies changed our plans.

The card I cancelled is managed through Citibank (who, BTW, took a huge chunk of tax payer money through bailout funds).

I’m a 3rd generation Sears card carrier in my family. My grandmother had a Sears card, as did my parents. Like my parents, we have used our Sears card for household emergencies (when the 4 year old fridge shot craps and when our 6 year old water heater bit the dust last year). The balance isn’t very high, which makes the over $10 a month, 25 percent finance charge even harder to swallow.

We’ve never missed a payment. We have an extremely high credit score and while the nice customer service manager acknowledged all of this last week, she said I could have opted out when they raised the rate, but I failed to do so.

While I take responsibility for my use of the card, they’re kidding right?

I could have opted to keep my lower rate, or because I somehow missed this important announcement in all of the junk mail we get, my rates were raised?

What kind of moron would intentionally not “opt out” of having their interest rate jump from 11 percent to 25 percent?

I calmly told the lady I would cut up my card and find a way to pay off the balance. This, I know, will also affect our credit score, as when you close a card, it lowers your credit rating.

So be it.

Part of our goals this year is to get ourselves out of most of the debt we’ve incurred and to build our emergency funds and savings back up.

We’re not alone, this recession has made people realize that we need to spend less and save more. As the pitchman for insurance on television says, “We’ve learned to do more with less.” People are fed up with debt and credit cards, as evidenced by their spending habits. The Federal Reserve reported this past November that revolving credit card spending fell to its lowest level since 1943.

So, keep raising our rates, you credit card companies, it’s just more incentive to eliminate more of the clutter from our lives.

Tell us about your credit card horror stories.

My credit card horror story is that I can’t get a credit card! I moved to Greece 4 years ago and thought to get a card for internet purchases, emergencies and car rental etc. Even though I offered to keep an account with the full credit limit deposited, the bank would not issue one for me! Cultural differences, huh? The way many have described it, credit sounds almost like a drug…

Vida, It can be like a drug for many people.

I have a friend on a tiny disability pension who was sent an unsolicited credit card in the mail. I begged her not to use it, she insisted she could be responsible, and of course the company kept increasing her limit as she used the thing. Now she’s in terrible debt with no way out but bankruptcy. It should be a crime for banks to let people with tiny fixed incomes get this far in debt! Of course she bears a lot of the responsibility for her own actions but they make it very hard to resist.

Alice, I agree that we live in a credit card society (or we did before the recession). If your friend is on disability and has no assets, she really doesn’t have to file bankruptcy. There is nothing they can attach. If all she can do is pay the minimum due, that’s what they will have to take.

Am I the only one amused to see all the credit card ads at the tp of this page by Google? Too funny. Hopefully life will calm down for me soon and I can blog about easy ways to stick it to the banks and sometimes get some satisfaction from them. In the mean time, banks like B of A (my least favorite) announce they are too big to fail. Well, I agree, so lets all chip in, and make them smaller. If you do cut up a card, do not cancel it. More later on my blog.

Russ

Thanks for chiming in Russ. The ads are pretty ironic, but they place the ads based on keywords. 🙂

We also are doing the Dave Ramsey thing. We read his book and took the class. Also got to see him live at my mother-in-laws church. He was wonderful. We started about 3 years ago and have paid off most all our debt. Then life happened. We ended up using a credit card we keep for emergencies. After you start to use a credit card again things get out of hand. We started using it for more then that. So, we are on our way to paying that card off again. I think Dave had something going when he said to plan ahead and to cut up those cards.

Thank you for posting this. It is something we all need to be doing. Let’s stop making the banks rich with OUR money and start putting it back in our pockets.

So sorry you got back into debt again, Fran. That’s happened to me several times. I don’t know how one could get through life without at least having that one, though. I travel some for my work and hotels and car rentals always require a credit card even if someone else is ultimately footing the bill.

Yes, I’m not sure if we will ever give up having one card. I know Dave Ramsey says that these places take debt but, I hate giving that one to to many places. This is my checking account we are talking about. I have a tight hold on that baby LOL. We have decided to just put the card in a draw and NOT use it. We will just keep it for travel and real emergencies(sorry Dave lol).

I agree with you, Fran. I worked in credit for 10 years before starting my freelance writing business and the amount of fraud out there is amazing. True, you can use your debit as a credit card, but I’m also afraid using that just anyplace and giving everyone in the world that number.

Good for you! I’m a big believer in using credit as a convenience, when it’s paid off every month, but things like this are truly insane.

Very insane and I’m not about to be ripped at loan shark rates.

Since taking a Dave Ramsey course on money, I quit using credit, pay with cash or debit. We built up an emergency fund, which helps when something unexpected happens. My husband kept only one gas card which he pays off every month. It feels so freeing.

The emergency fund is key, Shebear. We had one, but had to use it last year during the ice storm to buy a generator. We haven’t been able to build it back since. I will have to look into the Dave Ramsey course.

Kerri you might be able to check out his books at the library…I was able to.

here’s his website also

http://www.daveramsey.com/

Thanks, Susan!

I hate, hate the credit card companies! Great tips by everyone. I have only one card for emergencies – the rest we use our debit/check card only.

Welcome to Living Large!

Like many people I got into credit card debt out of necessity. Car trouble, kids in college were the 2 main reasons I carried balances. After my husband was laid off in 2006, we cleaned house– selling old furniture, collectible crap, clothing that had hung in our closets, our kids out grown clothes and stuff I had been holding onto for years. Pretty much anything we hadn’t used in 2 years – I sold it and paid down some of the balances. We went on a strict budget, accounting for every dime spent. We quit eating out, started planning our meals and eating leftovers. I switched credit card balances to offers that had 0-2% and in 18 months time paid them all off. It took hard work and dedication to get the job done. But ole what a feeling to be out of debt. I have stayed in the habit of watching my budget and spending and am putting money in savings every month. My next goal is to sell this house and build a smaller one that will be paid for. I’m almost there!

Your story is inspiring, Sandy. I plan to let most of the furniture and things we aren’t using go this spring.

I have several cards but only use one and pay it in full every month. I like the airline miles I accumulate. I do have a bad habit of losing track of time, though, and a couple of late payments and getting socked with a $29 late fee made me think up a new strategy – I set up an automatic payment of $100 from my bank each month. This isn’t enough to avoid an interest charge if I mess up and send in the payment late, but it IS enough to completely eliminate the late fee.

That’s a great strategy, Reader. Setting up electronic billing/pay is also good for the environment.

Amen Mary P! It took me a long time to reach that state of mind. It goes against so much that’s in our modern culture. Once we do make that commitment, it is quite liberating! Debt slavery destroys the joy of life.

I like that term, “debt slavery,” it was never described better.

I set a goal for myself 18 months ago to pay off all my Credit Cards…one by one! What really pissed me off was as I paid them down, and wasn’t charging any new items they lowered my credit limit. Which ultimately, affected my credit score too, because of the debt to limit ratio! Grrrr. I only have one left and it will be done for this July!!! I also, have been working on my emergency fund/savings so that if I have an emergency..tire need, car repair, unexpected Vet bill, etc. I will be able to pay from my emergency fund!!! It also ticks me off that when you book reservations, car rental, etc. they don’t want cash it isn’t good enough they want a credit card. Another Rant Grrrr Thanks, for the opportunity to Vent my frustrations!!! Think we all would be the wiser to pay cash when we are able or make do or do with out as I remember my Grandmother doing! Cindyt

Yay, Cindy! That must make you feel so good. Kudos to you. We’ll all have to give you a hearty congratulations come July!

We have one Discover card left- and the rates are up to 29.99%! We’re keeping it (no annual fees, no balance) just to keep our credit up, but we’re not using it. I hope the era of credit cards is ending… it’s amazing to think about the amount of money they have taken from American families, simply because we haven’t learned to save when we can and buy only what we can pay for with cash.

I thought it was interesting that Suze Orman changed her tune about credit this year, from “use it wisely” to “don’t give the crooks a dime of your money.” She earned an amen from me on that one.

OMG, Kim, we have a Discover card (again, for emergencies) and it isn’t anywhere near that high! I second that, “Amen!”

Good for you! We only use our debt cards or cash. We do have 2 credit cards, but they are only for emergencies or on the rare occasion when we rent a car. In the past, I found it was way to easy to overspend with credit cards.

I don’t have any horrible stories to share, I just try and stay away from credit cards. They are evil. 🙂

Yay for cutting them up!

It’s true that when you travel, you do need a card to book reservations and rent cars. I don’t like giving my debit card info to every person in the world. That’s why we’re only keeping two, and they are locked in a safe. To use them, Dale and I both have to approve the purchase and it really has to be something we need and cannot figure out any other way to get it.

Kerri,

I went through a messy divorce 19 years ago (gosh can it be that long ago!), and was left holding the bag on credit cards the hubby had taken out in my name, and I had no knowledge about. (He was military and stationed in Korea during our divorce) Long Story short, I ended up with the debt. I worked very hard to get free of that, and will NEVER have another credit card. I only have debit cards, and I book reservations, and rent cars with them.

I agree with someone earlier…having begun reading Dave Ramsey’s books, and some David Bach too (Start Late, Finish Rich), I am learning to keep an emergency fund that covers all those things most people carry a credit card for. If I tap it, the next month, I “pay the fund back”, just as I would pay off a credit card balance. Instead of paying insane interest rates, you are paying YOU. It is a very wonderful feeling to be able to pay for items in cash. Yes, you have to plan and think on purchases, especially the large ticket items (cars, RV’s, homes), but well worth the effort.

Life is much easier without credit cards. I guess the old adage “That which does not kill us makes us stronger….” is very true. Without credit cards, you find that there are very few “true” emergencies in life. Make do and do without.

Truth be known, Rhonda, anything we might ever need is probably in one of those piles of stuff that’s now in our storage buildings! 😉

I only use one credit card and pay the full amount each time. When I returned from Europe, I found my elderly parents dependent on their credit cards and only paying the required amount each month, so that they ended paying so much more. Needless to say, I quickly put an end to that practice! It is a shame the elderly often fall victim to the credit card companies many tricks ….

Yes, it is, Alexandra, and so sad that many seniors actually need the cards to buy things they need. Luckily, my mother got wiser as she grew older, but there were a few times her and my father got in way over their heads. They always had excellent credit, they both would have killed themselves working to pay their debt, but it’s not a good way to live.

Got rid of mine years ago. From what I was told about that “Opt out” by Citibank, they meant I could opt out of the rate increase, but the card had to be canceled to do so.

Well, ours is canceled now and it will be paid off this week!

It is unbelievable to me how credit card companies get away with loan sharking. I read there is now a new credit card with a 79% interest rate!! It’s of course, for those people so desperate and probably with credit scores so terrible that they have no choice. They are calling it a “sub-prime” credit card. As usual, banks sticking it to people who most need a break. Don’t even know what else to say about this post Kerri. I am so angry, disgusted and absolutely fed up with banks and insurance companies. What’s even worse are the people who somehow think these corrupt industries can be trusted to look out for our best interests, whether it’s health care or or management of credit. I wish someone would build a giant dunk tank and line all the insurance and bank executives up, then let consumers take turns trying to hit the target and dump them one by one. Sigh….one can dream.

Oh, what a funny visual. A great big dunk tank fund raiser, and the proceeds can go toward helping the unemployed and people who have no health insurance!

Yeah! We need to start a facebook group! We can call it the “Let’s Build A Giant Dunk Tank For Insurance and Bank Executives!

I’m all for it!

I cut my cards up also. I am now trying to pay off the last credit card bills we have. Due to a old work comp battle that has turned nasty and in court, I got behind in paying off these last little cards, and am now trying to get my ducks in order to pay these off, if we get back work comp pay and back wages owed from an employer who did not pay wages for 6 mons.

I have learned my lesson well,no debt and if you do not have the money to get it, go without or make due until you can. Don’t get caught with your knickers down like we did.

Good advice. I plan on living the second half of my life debt free!

That’s a very good policy, Mary!

I no longer have any credit cards. I cut all mine up several years ago when I got in over my head and was struggling to pay them off. Now I use a debit card, basically paying cash for everything, and if I don’t have the money in my account to cover what I want then I do without until I can save it up.